Overview of the islamic financing industry

Overview of the islamic financing industry

Islamic Financing refers to financing and investment activities that are permissible and adhere to the principles of Sharia.

Since the introduction of Islamic financing during the 20th Century, the sector has been growing at a rate between 15%-25% per year accumulating an oversee market work of $2 trillion in assets. Islamic financing attributes to 6% of the global financing assets and the global Sukuk value resting at USD 538 billion. Economists are projecting an increase in the market scope to US$2.44 trillion by 2024.

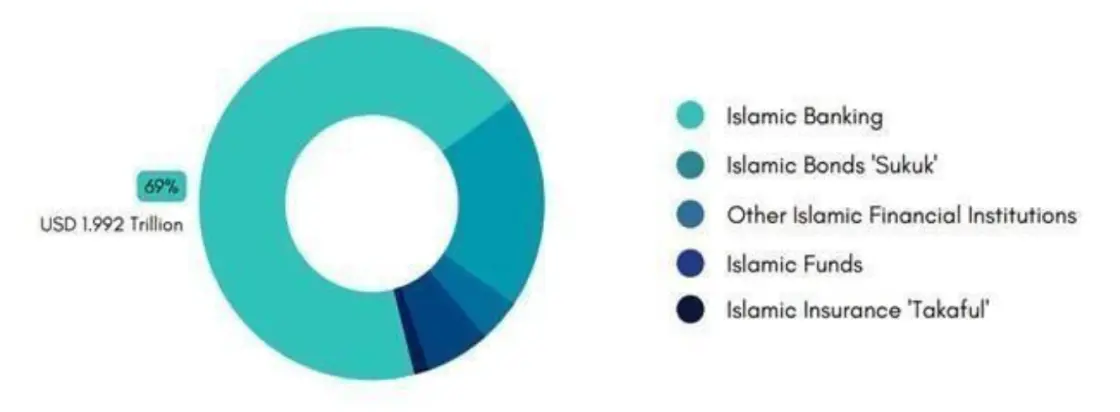

The Islamic industry is dominated by the financing sector, comprising 69% (USD 1.992 trillion) of total industry assets. Various other segments are emerging to support the broader financial landscape this comprises but not limited to Sukuk’s, mutual funds, takaful, Microfinance institutions and Islamic SACCOs to mention a few.

Pioneers in the market are optimistic having seen the risen interest of investors in the market engaging in more Islamic shariah compliant products.